No cash out refinance vs. limited cash out refinance

Confused about no cash out refinance vs. limited cash out refinance? Discover the benefits, differences, and which option is best for your mortgage strategy.

Read more

Confused about no cash out refinance vs. limited cash out refinance? Discover the benefits, differences, and which option is best for your mortgage strategy.

Read more

Learn how an adjustable-rate mortgage could work for you, get ready for a fresh wave of inventory, and decide if summer is your time to shine as a seller.

Read more

With a cash out refinance, you take out a new mortgage for more money than you owe on your current loan. The difference is paid to you in cash.

Read more

Need the tools to find the right rental property for you? It all comes down to how to think about your return on investment.

Read more

Use this cash out refinance calculator to see how much you could borrow and what the cost of your new monthly payment would be.

Read more

Working with the right real estate agent can give you an enormous advantage as a homebuyer. See the best strategies for how to find a realtor, including key questions to...

Read more

The spring market comes with low inventory and intense competition, but buyers can win by being prepared to move fast.

Read more

Discover how this couple saved big on their new build home with smart tips, expert strategies, and financing advice. Learn how to save on your dream home too!

Read more

Here are the counties that have seen the biggest growth in housing over the last decade.

Read more

A recently divorced single mom uses Better’s Cash Offer to get a home for her family lightning quick.

Read more

A newly married couple buys a home to put down roots near family and connect with their community.

Read more

A veteran and her wife find a lender and put an offer on their dream home 7 hours after seeing it—the rest is history.

Read more

Meet a couple who landed their dream home with high-speed help from Better Mortgage. Plus, the renovations that boost your home value and a tip for winning with cash.

Read more

Newlyweds take the plunge on their first home with Better’s Cash Offer program.

Read more

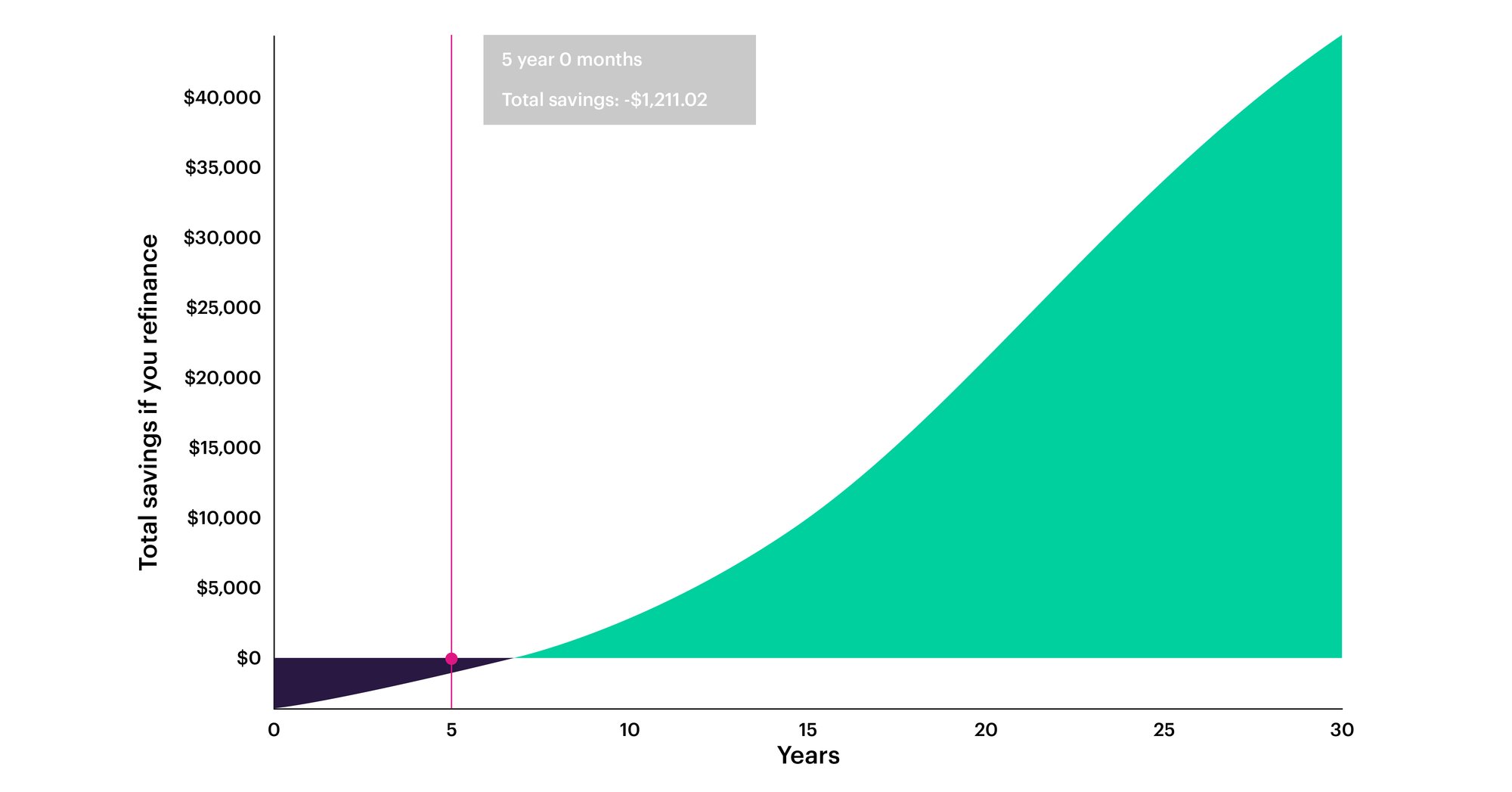

Try this refinance calculator to understand how much you could save if you refinance your mortgage.

Read more

Wondering “How much does it cost to refinance?” Here’s your guide to the short- and long-term costs of refinancing your mortgage.

Read more

Better compiled a list of 15 events and milestones in the history of the American mortgage system, using information from news articles, encyclopedias, and historical literature.

Read more

Better analyzed U.S. Census Bureau data to determine how homeownership rates have changed over the past 25 years.

Read more

With mortgage rates on the rise and suburban competition heating up, discover smart strategies to navigate today’s dynamic and fast-moving housing market.

Read more

Refinance appraisal higher than expected? Understand the appraisal process, associated costs, and what it means for your refinancing options and mortgage terms.

Read more

Need something else? You can find more info in our FAQ