Why I Started Better Mortgage

Discover the story behind Better Mortgage and how one missed home inspired a simpler, faster way to buy a house. Your path to homeownership starts here.

Read more

Discover the story behind Better Mortgage and how one missed home inspired a simpler, faster way to buy a house. Your path to homeownership starts here.

Read more

Choosing the right neighborhood is one of the most important (and difficult) parts of buying a house. Here are some tips to help you make that decision.

Read more

Discover the best places to live in New Jersey, what’s unique about the real estate market, how to find a New Jersey Realtor, plus 7 steps to buy a home.

Read more

Considering an out-of-state move? Don’t overlook these cities with lower costs of living and affordable homebuying options.

Read more

Learn what to expect during the mortgage loan closing process, including key steps, timelines, and tips to ensure a smooth and successful home purchase.

Read more

From instant pre-approval letters to eliminating unnecessary costs, here’s how digital lenders make homebuying more convenient, transparent, and speedy.

Read more

How are real estate taxes calculated? Learn what affects them, how to potentially lower your bill, and how they impact your home search, upgrades, and budget.

Read more

From how budgeting really works to whether you should have a real estate agent, asking these questions when buying a house will give you a competitive edge.

Read more

Looking for mortgage advice? This guide breaks down rates, refinancing, and top FAQs to help you choose the best loan and timing for your home financing goals.

Read more

Thinking about buying a second home? Learn key rules, lender requirements, and expert tips to qualify, secure financing, and buy your dream second home.

Read more

Buying a house out of state can be seamless with the right prep. Learn how to find an agent, compare homes, and close without setting foot in the state.

Read more

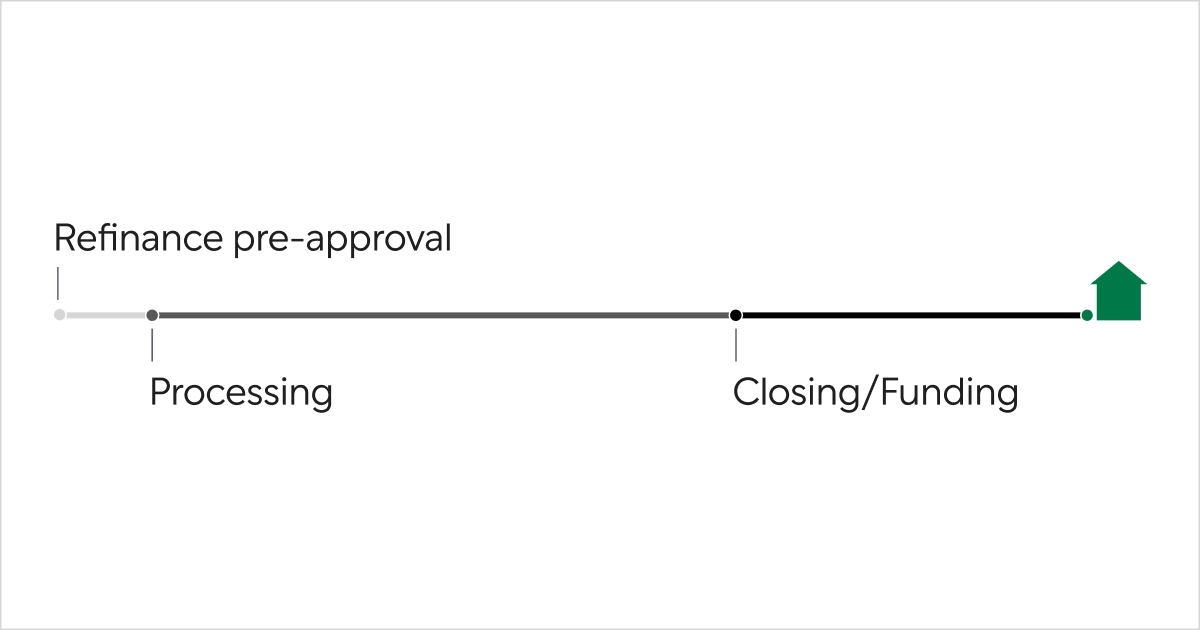

Refinancing can help homeowners save money, but the process can be complex. Here's how Better simplifies it and what you can expect from start to finish.

Read more

Learn what makes property value increase and learn 10 important factors that significantly impact how much a home is worth when buying, selling, or refinancing.

Read more

Looking for a house that truly fits your needs? Don't rely on a gut feeling. Get tips from a Better Real Estate Agent on how to know if a house...

Read more

Inspired by his own homebuying frustrations, Vishal Garg founded Better to reinvent mortgages with a seamless, faster, and customer-focused online experience.

Read more

HomeReady vs FHA loans: See how an affordable home financing program that offers low down payment options like HomeReady stacks up against FHA loans.

Read more

Each season has its pros and cons: We’ll help you identify your best time of the year to buy a house based on how you prioritize price, choice, and timing....

Read more

Mortgage application denied? Discover common reasons for denial and expert tips to strengthen your next application and boost your chances of getting approved.

Read more

Learn what a closing package is, why it matters, and how it finalizes your home purchase so you can confidently navigate the last step of the mortgage process.

Read more

Learn how a loan estimate reveals real mortgage costs, compares lenders, and highlights fees you can control. Explore its sections and compare offers clearly.

Read more

Need something else? You can find more info in our FAQ