How does buying a house affect taxes

There is a range of tax deductions homebuyers or homeowners can use to lower their tax bill. Learn which tax breaks apply to your and what tax forms to use.

Read more

There is a range of tax deductions homebuyers or homeowners can use to lower their tax bill. Learn which tax breaks apply to your and what tax forms to use.

Read more

Buying a condo comes with plenty of perks, but here’s what you need to consider before committing to this type of home.

Read more

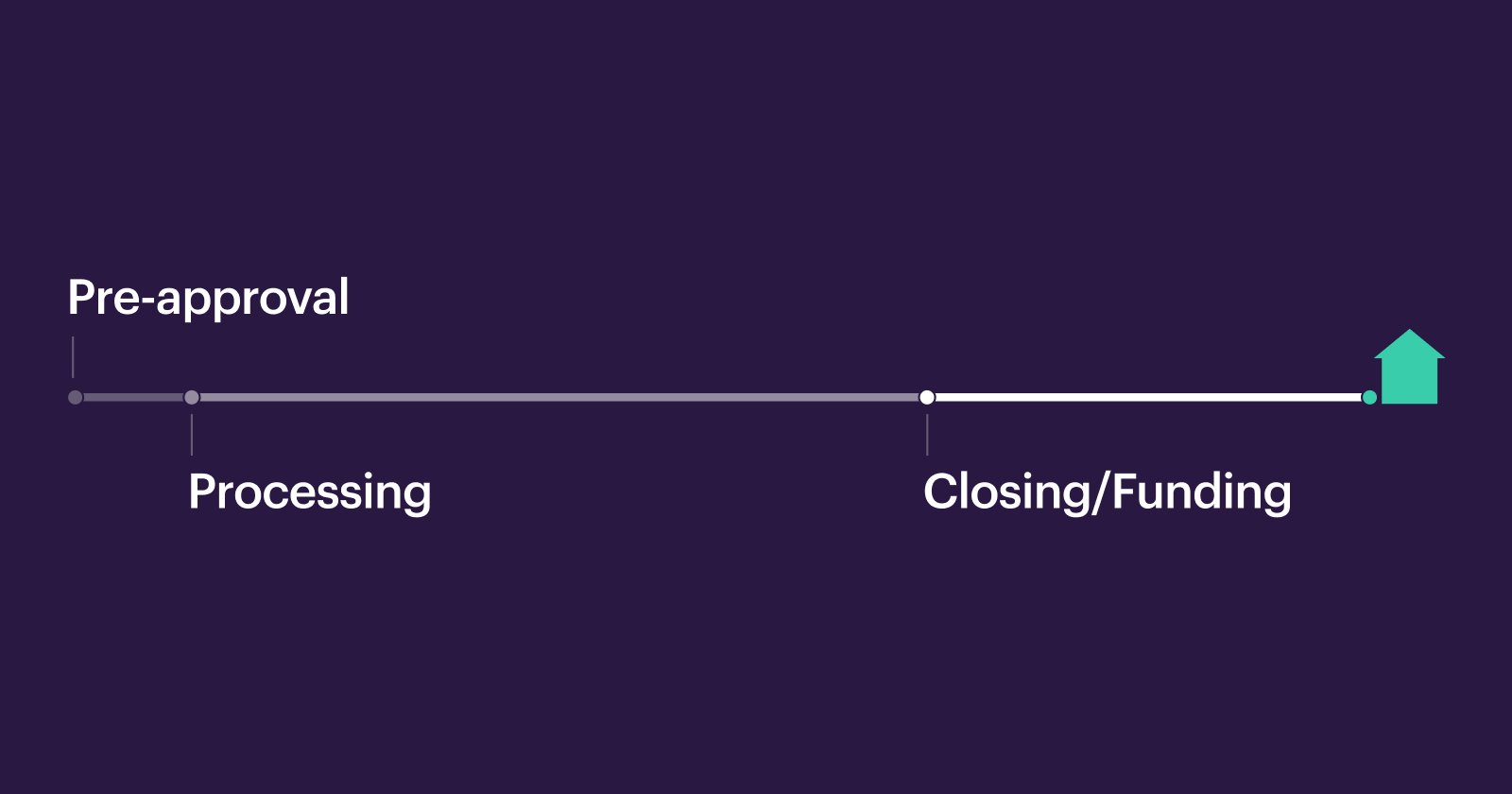

Explore our detailed home buying process timeline to understand each step from pre-approval to closing and learn how to move forward with confidence.

Read more

Learn the differences between jumbo vs conventional loan types, county loan limits, qualifying guidelines, and how to know if you should consider a jumbo loan.

Read more

Tips for comparing the affordability of renting and buying a home, and deciding which one might be right for you.

Read more

Get approved for a mortgage for self-employed borrowers: understand income docs, tax write-offs, down payment proof, and tips to boost eligibility with lenders.

Read more

How are real estate taxes calculated? Learn what affects them, how to potentially lower your bill, and how they impact your home search, upgrades, and budget.

Read more

From how budgeting really works to whether you should have a real estate agent, asking these questions when buying a house will give you a competitive edge.

Read more

Looking for mortgage advice? This guide breaks down rates, refinancing, and top FAQs to help you choose the best loan and timing for your home financing goals.

Read more

Learn what makes property value increase and learn 10 important factors that significantly impact how much a home is worth when buying, selling, or refinancing.

Read more

HomeReady vs FHA loans: See how an affordable home financing program that offers low down payment options like HomeReady stacks up against FHA loans.

Read more

Mortgage application denied? Discover common reasons for denial and expert tips to strengthen your next application and boost your chances of getting approved.

Read more

Learn how a loan estimate reveals real mortgage costs, compares lenders, and highlights fees you can control. Explore its sections and compare offers clearly.

Read more

In the socially distanced world of 2020, Better helped 88,100+ new clients navigate their homeownership journey with ease, confidence, and a ton of savings.

Read more

Many different types of mortgage loans exist, including fixed-rate, adjustable-rate, jumbo, FHA, and more, each with advantages for different homebuyers.

Read more

Rent-to-own is an alternative to buying a home outright. For those who might not qualify for a traditional mortgage, rent-to-own offers a path to ownership.

Read more

Gifts letters are common in financing the down payment for a home. Find out the benefits and drawbacks of using gift funds towards your mortgage.

Read more

More than half of homebuyers with children in school shop by school district. Here's what to know about the impact that can have.

Read more

Thinking of buying a home soon? Explore options & compare the pros and cons of renting vs. owning to see what fits your lifestyle, budget, and long-term plans.

Read more

Chances are you want to get a good deal on your mortgage. This post is all about breaking down mortgage rates and costs, so you can be a savvy shopper.

Read more

Need something else? You can find more info in our FAQ