Fixed-rate loan comparison calculator

Our loan comparison calculator is designed to show you when the costs of your two fixed-rate loan options are the same — also known as the break-even period. So whether you stay in your home for 5 years, or 25, you’ll have all of the info you need to make the right decision about which loan is right for you.

Option A

Learn more about Points and Credits

Option B

Break-even period

After 9 years 2 months, Option A will be less expensive than Option B

When we took into account upfront costs and interest, both options cost the same at the 9 year 2 month mark. If you plan to own your home less than 9 years 2 months, Option B is a better choice.

Option A

2.625%

Loan term

30-year fixed

Points

$5,812

Monthly payment

$1,607

Lifetime cost

$584,189

Option B

2.750%

Loan term

30-year fixed

Points

$2,924

Monthly payment

$1,633

Lifetime cost

$590,791

How to choose a home loan

It can be overwhelming to evaluate your home loan options, but it doesn't have to be. As it turns out, there are a few important numbers you can focus on first. Our loan comparison calculator takes into account the length of a loan, as well as the interest rate, loan amount, and whether you'll have points or credits. Once you've decided to go with a fixed rate instead of an adjustable one, you'll want to start to consider all of those details. We're here to help them make a little more sense along the way.

First up, you'll want to think about the term. In other words, would you like to make smaller payments over a longer amount of time? Or would you prefer to make larger payments, but over a shorter period of time? The loan amount could vary too, based on how much of your assets you're willing to use for a down payment. Trying out both options show you how much you save each month, as well as over time, so it's easier to weigh the benefits.

Some of the most confusing factors you'll tackle when you're comparing loan options are the interest rate and points and credits. Luckily, they're closely connected to one another. Once you understand that relationship, they're easier to compare. Basically, most loan options will have the option of either points or credits, and that has an effect on the interest rate that's available to you. When you choose a loan option with points, you're opting to pay more upfront at closing in exchange for a lower interest rate. So while your costs are higher at first, you may notice you pay less in interest over the life of the loan. On the other hand, choosing a loan option with credits means you'll save some money upfront on closing costs in exchange for a higher interest rate. This is a great option if you're hoping to keep costs lower at first, but it does cost more over time.

All of these factors work together, so it's best to compare their effects over time by using a tool like our calculator that stacks them against each other. At the end of the day, a major question you'll need to tackle is: how long do you plan to stay in your new home? For example, if you plan to sell or refinance before your break-even period (the point at which both loan options cost the same), you'll want to choose the loan option that costs less in the short term. However, if you plan to stay in that home for the life of the loan, you might care a little less about the short-term costs, and instead you will want to pay more attention to how the costs shift after that break-even period. In other words, which loan option costs less during the time you'll be living in the home, or before you refinance?

If you're comparing drastically different fixed-rate loan options — with varying terms and amounts, for example — you may not have a break-even period at all. In those cases, you'll also want to think about how long you plan to stay in the home, as well as which option is more financially feasible for you.

The mortgage you choose today will impact your finances for years to come. It will determine your upfront expenses, monthly payments, and long-term costs. But, don’t worry. Our fixed-rate loan comparison calculator will crunch the numbers for you so that you can choose the right home loan for your needs.

Why your loan options matter

Mortgages come in all shapes and sizes. Your loan term, interest rate, and points or credits will significantly affect your monthly mortgage and long-term costs. Let’s review why each loan option matters.

Your loan term

Your loan term is the length of your mortgage. It helps determine your monthly payment and how much interest you’ll pay throughout the loan. Common fixed-rate mortgages include 15-, 20-, or 30-year terms.

The shorter the term, the quicker you’ll pay off your mortgage, which means you’ll pay less in interest. However, each monthly payment will be larger because you’ll have a shorter time frame to pay. On the other hand, a longer-term may provide you with a more affordable monthly mortgage. But it also means you’ll be paying more in interest over time.

A mortgage comparison calculator can help you determine how each home loan may fit into your budget now and in the future.

Your interest rate

Your mortgage interest rate is the amount you pay a lender for providing you the money to buy your home. Interest rates are expressed as a percentage, and the higher the rate, the more you’ll pay.

Your credit score

Your credit score tells lenders how risky it might be to issue you a mortgage

A higher score indicates that you have a good history of paying back your debts on time. This will qualify you for a lower interest rate because it shows you're likely less of a risk to lenders. A lower credit score means more risk for lenders, and that means you’ll probably pay a higher rate

Your loan-to-value ratio

When you present less risk to a lender, you’re more likely to get a lower interest rate. To reduce your loan-to-value ratio (and possibly your rate), consider making a larger down payment or purchasing a less expensive home.

The economy and inflation

While we won’t get into the nitty-gritty here, it’s important to know that mortgage interest rates are greatly impacted by what’s going on in the financial markets. Economic factors, such as U.S. economic growth, monetary policy, the bond market, housing market conditions, and inflation can all affect rates. Learn more about how the economy impacts rates here.

Your points or credits decision

How a mortgage comparison calculator can help you choose a home loan

A mortgage comparison calculator factors in all the details about two home loans you’re considering and helps highlight the best financial choice for your situation. Here’s how:

It helps you compare mortgages with different terms and costs

If you’re comparing mortgages with varying lengths and expenses, it can be tough to tell which costs more in the short- and long-term. A calculator simplifies the process and shows you what each home loan will cost you upfront, every month, and over time. This helps you see how a particular mortgage would fit into your financial picture at different points.

It acts as a loan interest calculator

It helps you calculate the lifetime loan amount

The sum you borrow to cover the sale price of your new home is different from the lifetime cost of your mortgage. That's because your lifetime loan amount includes the principal (the amount to cover the home purchase), interest (what you pay the lender), and points or credits (which help you save money at closing or in interest). A loan comparison calculator considers all of these expenses and can help you understand your total cost to become a homeowner.

It shows your break-even point

The break-even point is when the two mortgages you’re comparing will cost you the same amount of money. This is important because it can help you determine which loan makes the most sense based on your plans.

If you believe you’ll sell or refinance your home before you reach the break-even point, then the loan that costs less before that mark may make more financial sense. But, if you think you’re buying your forever home and don’t plan to refinance, then choosing the home loan with the lowest long-term costs may save you the most over time.

Note that you may not have a break-even point if the two mortgages you’re comparing have drastically different loan terms or amounts. In this case, you should select the best option for your financial situation.

How to determine which home loan is right for you

When reviewing your mortgage options, you’ll want to consider the following:

- How your mortgage will fit into your monthly budget. This can help answer the question, “how much home can I afford?

”

Your savings, which can help determine your down payment and ability to purchase mortgage points.

Your future plans, especially how long you expect to live in the home.

It’s important to note that what you see in the mortgage comparison calculator may vary from your actual mortgage figures. However, having a visual that shares how different mortgages affect your short- and long-term costs can help you narrow down the right option.

The next step

Disclaimer: This home affordability calculator is made for illustrative purposes only. Accuracy is not guaranteed.

Mortgage resources

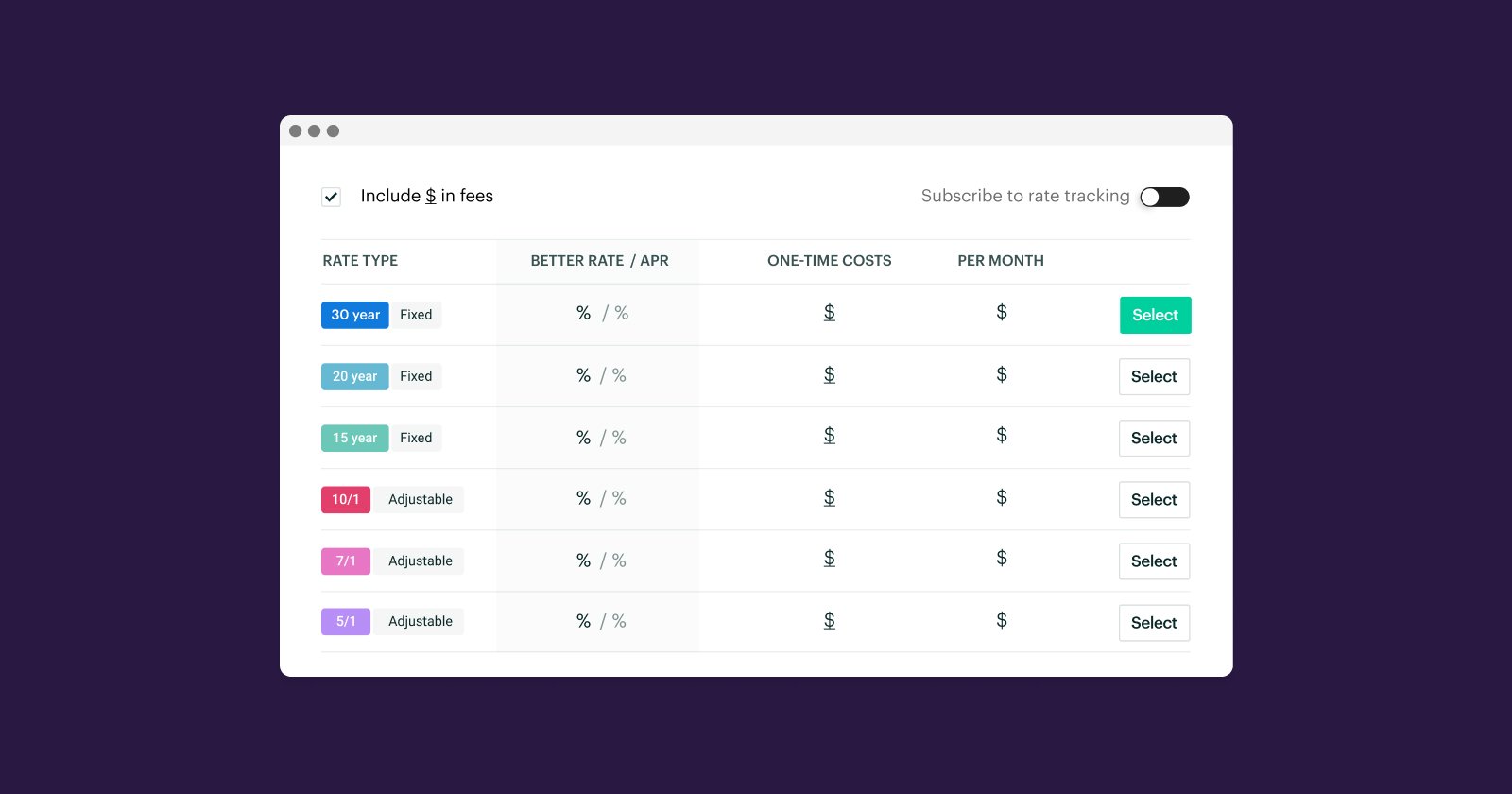

What to look for when comparing mortgage rates

Learn how to read a mortgage rate table—a powerful comparison tool to help you choose the best home loan for your needs—in this new article from Better Mortgage.

Points, credits, and how to decide if they’re right for you

When looking at a mortgage, paying points means paying more upfront for a lower interest rate. On the other hand, getting credits means paying less at closing in exchange for a higher interest rate.

What documents will I need for my mortgage?

Mortgage paperwork can often seem confusing, but this handy guide breaks down exactly what documents you’ll need.