Cash out refinance calculator

Use this cash out refinance calculator to see how much you could borrow and what the cost of your new monthly payment would be.

Read more

Use this cash out refinance calculator to see how much you could borrow and what the cost of your new monthly payment would be.

Read more

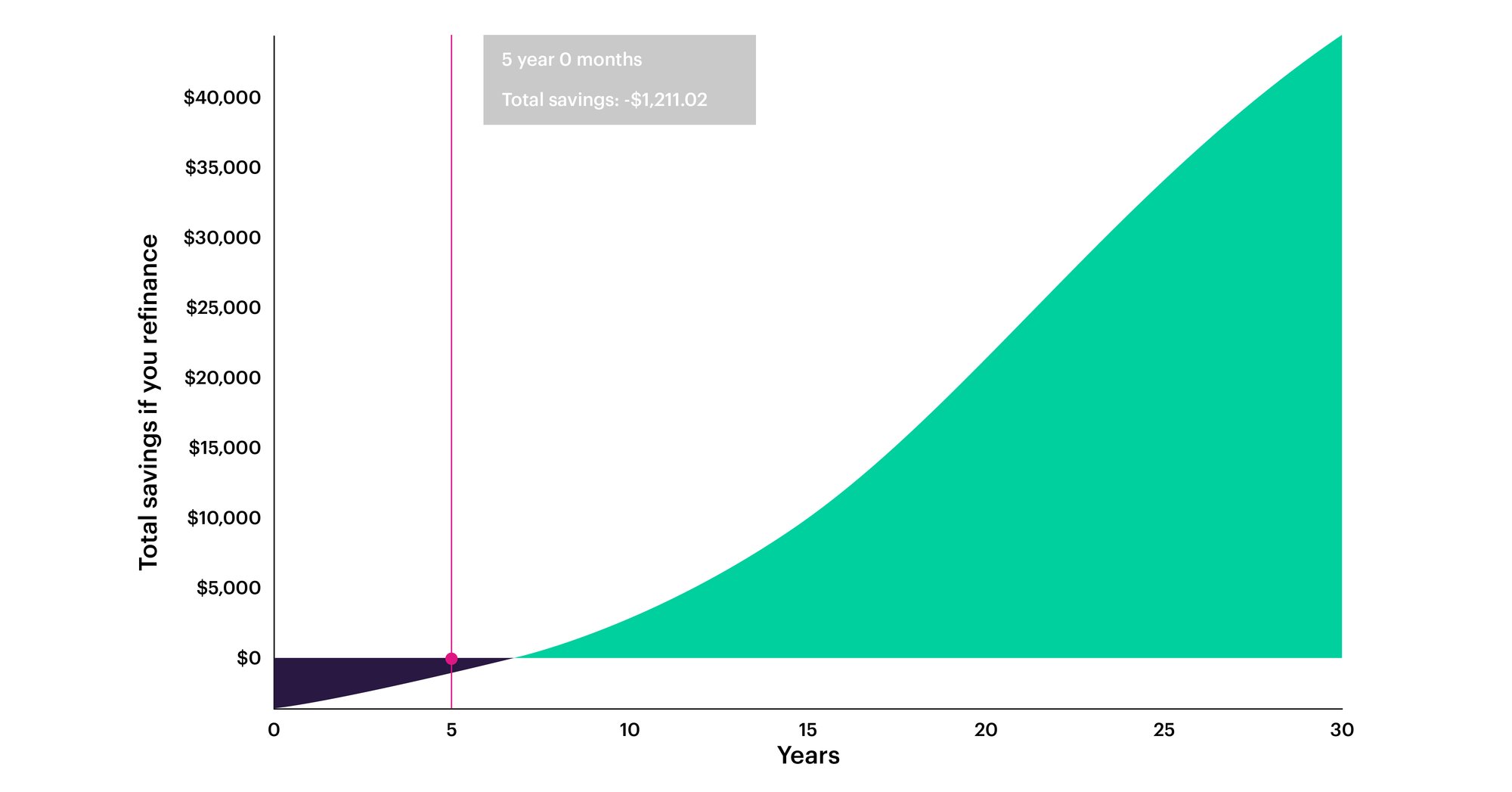

Try this refinance calculator to understand how much you could save if you refinance your mortgage.

Read more

Better compiled a list of 15 events and milestones in the history of the American mortgage system, using information from news articles, encyclopedias, and historical literature.

Read more

Better analyzed U.S. Census Bureau data to determine how homeownership rates have changed over the past 25 years.

Read more

Conventional loans are the most common mortgage type in the US. Here we explain what makes them different from other mortgage options and how to get one.

Read more

Why wait, save, and pay rent to your landlord when you could be paying off your own home. See why smaller down payments can unlock the door to homeownership.

Read more

Refinancing your mortgage? You may want to buy down your interest rate by purchasing points, which can save you thousands over the life of your loan.

Read more

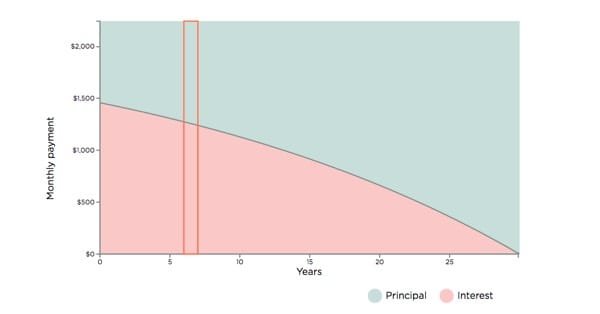

Try this interactive amortization calculator to find the amortization schedule for any fixed-rate mortgage.

Read more

Wondering what are points on a mortgage? Learn how they work, how buying points lowers your interest rate, and whether they can truly save you money over time.

Read more

We looked at notable design trends over the past 100 years to see how American homes have changed.

Read more

Here’s how much home prices and average interest rates have risen since 1950.

Read more

Jumbo loans are mortgage loans that have a higher-than-normal balance. Here's what you need to know about securing this type of financing in 2021.

Read more

Learn if mortgage pre-approval is free or has costs, and understand what to expect from the process before you start the exciting journey of buying a new home.

Read more

Looking to buy a property that makes money for you? Learn the minimum qualification requirements to get a mortgage pre approval for an investment property.

Read more

Many homebuyers boost their borrowing power by purchasing a home with a partner. Discover the benefits and learn how to get a joint mortgage pre-approval.

Read more

Here we deep dive into what you can expect when you transition from scrolling through homes online to going to open houses, making an offer, and closing.

Read more

Discover how loan subordination lets you refinance while keeping a second mortgage: What it is, how it works, key steps, and why it’s important.

Read more

Wondering if getting pre-approved hurts your credit? Discover how credit checks work and simple ways to keep your score safe during the mortgage process.

Read more

Homeowners who were previously denied a mortgage refinance may now qualify through RefiPossible™. You may save up to $3k/yr by lowering your monthly costs.

Read more

Understand appraisal contingency: how it protects buyers, affects mortgages and LTV, options when appraisals are low, and when it’s smart to safely waive.

Read more

Need something else? You can find more info in our FAQ