What to look for when touring a home

Touring homes is an exciting part of the home purchase journey. Here’s a guide to help you tick all the (not-so-obvious) boxes to find your dream home.

Read more

Touring homes is an exciting part of the home purchase journey. Here’s a guide to help you tick all the (not-so-obvious) boxes to find your dream home.

Read more

Buying a condo comes with plenty of perks, but here’s what you need to consider before committing to this type of home.

Read more

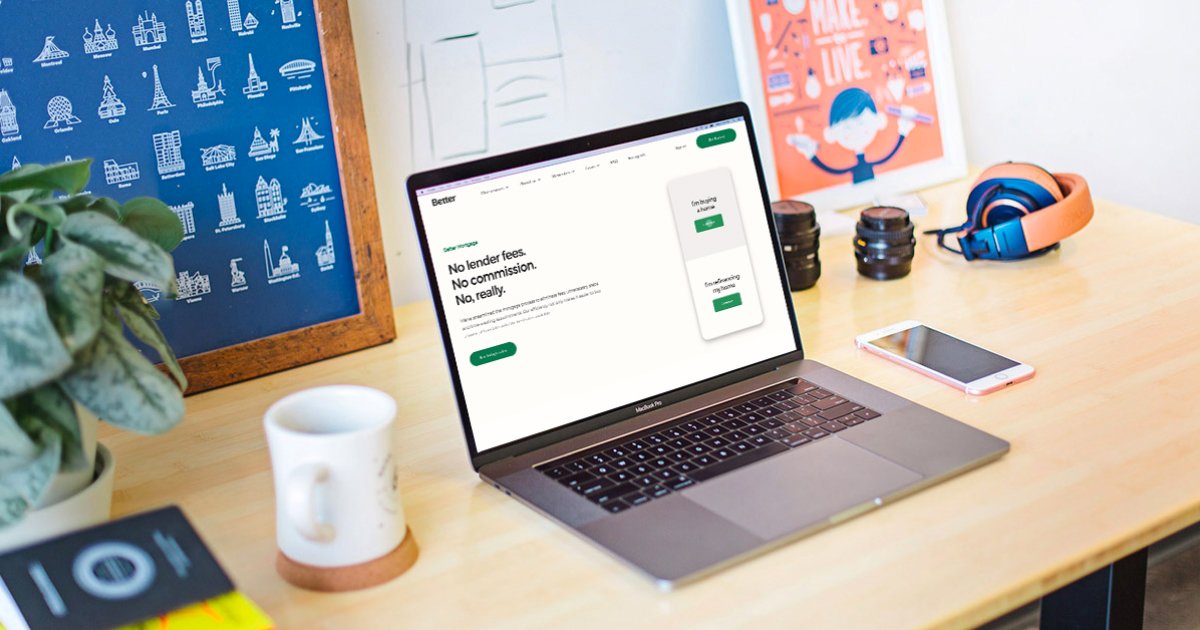

Want to use an online lender to buy or refinance your home? Get pre-approved for a mortgage online easily with Better Mortgage, on your schedule and terms.

Read more

Discover conventional loan requirements, how they compare to FHA and VA loans, and find out if this type of mortgage is the right fit for your situation.

Read more

Thinking of buying a home soon? Explore options & compare the pros and cons of renting vs. owning to see what fits your lifestyle, budget, and long-term plans.

Read more

Getting ready to apply for your first mortgage? Make sure you know what to expect. Here’s a step-by-step breakdown of the entire mortgage process from start to finish.

Read more

Learn what mortgage lenders are looking for when evaluating a loan application — and what first-time homebuyers can do to meet their requirements.

Read more

What’s the difference between fixed and adjustable rate mortgages? What are points and credits? How will your down payment affect your interest rate? We have your answers.

Read more

Being a self-employed borrower can make homebuying more complicated. But with the right planning and people to help you, it can be easier. See what you can do now to...

Read more

Buying a house is overwhelming, especially for a first-time homebuyer. But with the right preparation, you can take control and avoid the most common homebuying hurdles. We’ll show you how.

Read more

Real estate PMI, or private mortgage insurance, is required for low down payment mortgage loans. Learn about how real estate PMI can impact your mortgage costs.

Read more

Don’t let these common first-time homebuyer myths and misconceptions scare you away from buying your dream home.

Read more

You may have gotten pre-approved to buy a home, but the property itself can impact what house you can afford.

Read more

Mortgages can be confusing, even if you’ve gotten one before. Here’s a breakdown of all the costs that come with getting a mortgage.

Read more

Whether you’re buying or refinancing a home, mortgage rates can seem confusing. Here’s a quick overview to help you shop rates with confidence.

Read more

Learn how to lower debt to income ratio for mortgage approval. Understand what affects your DTI ratio, why it matters, and how to qualify for better rates.

Read more

Considering a 5% down payment for your mortgage? We're here to help demystify the low down payment mortgage.

Read more

While traditional fixed rate mortgages have the same rate for the entire life of the loan (typically 15, 20, or 30 years), adjustable rate mortgages (ARMs) are a bit different.

Read more

Your loan estimate is a summary of the terms and costs associated with your loan. Learn how to read and understand it with confidence.

Read more

Need something else? You can find more info in our FAQ